Just think of being an entrepreneur or businessman, you are a man of your own will, no strict and hectic schedule to reach office or listening to blatantly rude remarks of your exasperated boss! How would you feel if you can just sit back, satisfied, contented, watching you bank balance figures grow exponentially.Sweet dreams huh? Well trust me, its not that difficult to materialize this dream of yours! 🙂 I am talking about stocks, more specifically, owning stocks. I think of stock trading to be one of the best methods to grow wealth.When you start on your road to financial freedom, you need to have a solid understanding of stocks and how they trade on the stock market. I have observed that interest of people in STOCKS has grown drastically over the last few decades.This demand coupled with advances in trading technology has opened up the markets so that nowadays nearly anybody can own stocks. But simultaneously, there are still many people who are illiterate when it comes to stocks. Much is learned from conversations around the water cooler with others who also don’t know what they’re talking about. Chances are you’ve already heard your elders , like grandparents say things like “Stocks are risky, you can loose everything, its a gambling game, so stay away from stocks!”, and at the same time must have also got awestruck by seeing the hefty pockets of others.So much of this misinformation is based on a get-rich-quick mentality, which was especially prevalent during the amazing dotcom market in the late ’90s. People thought that stocks were the magic answer to instant wealth with no risk. Stocks can (and do) create massive amounts of wealth, but they aren’t without risks. The only solution to this is education. The key to protecting yourself in the stock market is to understand where you are putting your money. Remember- EDUCATION CAN SAVE YOU! So here’s something that can give you a jump start!

I found this interesting video on Youtube which actually tells you what stocks are, and why does a company issues stocks! What happens when you buy a stock of a company when the company grows, the value of that stock increases, and you become rich! This is a real simple video which can teach even a teenager about ‘stocks’. – STOCK MADE EASY-by WallStreeSurvivor

This video takes an example of Julie who lives in Paris, and wants to open a bakery.

She calculates the total cost of opening up a bakery, including the supply, the staff and cost of starting a business, it comes out to be $100, 000! A BIG PROBLEM: Julie has only $10,000. So she takes $10,000 each from her 9 friends and makes them the stock owner/ or share holder of 10% each!

After 5 years, when the company grows to $1000,000, each of the investors(friends) turn their investments from $10,000 to $100,000! This is the power of stocks!

Similarly, you can purchase stocks of various public and private companies.

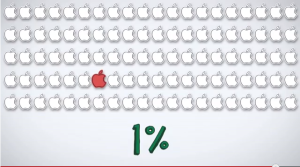

Stock/share/equity. Well they all mean the same! 🙂 ‘SHARE’ simply, as told by the meaning, is your ownership of the company. This ownership is nothing but the firm’s assets and earnings. So, more the number of stocks of a company owned by you, more is your ownership stake in the company. for example- suppose apple has 100 shares, and you own one of them, your ownership on company is 1%.

A building is made of number of bricks and all the bricks combined, make a building. Same is with company and stocks. Where in, company is a building and stocks are the bricks. If you own at least one stock of a company, you are called the owner of stock, or SHAREHOLDER, because stock is nothing but a tiny share of the

company(just like brick is a tiny share of a building!!) Being a shareholder means that you have a share on company’s profits and assets. Now it definitely makes sense to say that your share on company increases with ownership of stocks. The best thing about being a shareholder is that the growth, development, and management of the company is beyond your concern, you just sit back, relax, and enjoy profits as company grows! Moreover, if the company suffers a loss, even if it is as big as bankruptcy, you do not loose your personal assets( your personal assets can be anything you see around in your house, your electronic items, furniture..etc), in fact ,the maximum loss you can ever suffer is the value you have invested while buying stocks! Cool enough, isn’t it?

One other thing is that an online business administration diploma is designed for college students to be able to without problems proceed to bachelors degree programs.

The Ninety credit diploma meets the other bachelor diploma requirements and when you earn

your current associate of arts in BA online, you will get access to the newest

technologies on this field. Some reasons why students would like to get

their associate degree in business is because they’re interested in the field and want to get the general instruction necessary before jumping in a bachelor college diploma program. Thanks alot : ) for the tips you really provide within your blog.

(Y)